Lifetime Brands, Inc.: A Closer Look at Recent Performance and Future Prospects

In the wake of recent financial disclosures, shareholders of Lifetime Brands, Inc. (NASDAQ: LCUT) might be feeling a wave of uncertainty. Following the announcement of its first-quarter results, the stock experienced a staggering 9.8% drop, now trading at just US$3.23. Let’s delve deeper into what this means for investors and the brand’s trajectory moving forward.

A Disappointing Earnings Report

Lifetime Brands reported revenues that met expectations at US$140 million, but the news was marred by mounting losses, recording a loss of US$0.19 per share. Such figures often prompt analysts to reassess their forecasts, and the aftermath of this report is no different. A close examination reveals that while some expectations remain steady, the overall outlook is less rosy.

The Analysts’ Shift in Perspective

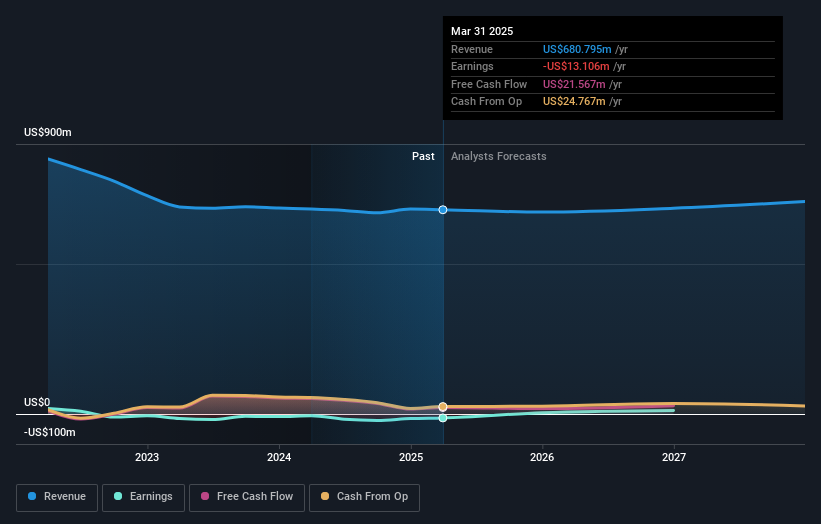

According to current forecasts, analysts expect revenues for 2025 to be around US$673 million, parallel to last year’s performance. In contrast, prior to the latest earnings report, predictions were more optimistic, with an anticipated US$693.1 million in revenues and earnings per share projected at US$0.30. The downward revisions in revenue and earnings per share indicate a shift in analysts’ optimism regarding the company’s future.

Identifying Red Flags

In analyzing the sentiment surrounding Lifetime Brands, we can’t ignore the two significant warning signs that have surfaced. Learn more about these signals here.

Figure 1: Earnings and Revenue Growth Forecast for Lifetime Brands

Market Sentiment and Price Targets

The consensus price target has seen a notable 29% reduction, now standing at US$6.00. Such a decline in forecasted value underscores the broader concern regarding Lifetime Brands’ earnings outlook. In comparison, overall industry revenue is projected to grow 4.1% annually, leaving Lifetime Brands at a competitive disadvantage with potential annualized revenue declines of 1.5% through 2025.

Industry Comparisons

When juxtaposed with performance trends from competitors within the consumer durables industry, it becomes evident that while some companies are set to thrive, Lifetime Brands is forecasted to lag. The company’s historical revenue decline of 3.8% per annum further emphasizes the need for strategic changes moving forward.

The Bottom Line

The landscape for Lifetime Brands appears challenging as analysts have reduced their earnings estimates, painting a cautious picture of what lies ahead. Despite the anticipated shift to profitability, as indicated by projections suggesting earnings of US$0.01 per share, the downgrades signal possible business headwinds that need to be addressed.

In summary, while some financial indicators hint at potential improvements, the overall outlook remains clouded by competitive pressures and reassessed forecasts. Long-term sustainability is invaluable; thus, investors should keep a watchful eye on analyst estimates extending to 2027, which are available for free here.

Additionally, to uncover more about the warning signs associated with Lifetime Brands, consider reading further here.

If you’re considering investing in Lifetime Brands, you might want to explore brokerage options that cater to your trading needs. Open an account with Interactive Brokers for low-cost trading solutions.

This article is intended for informational purposes only and does not constitute financial advice. It reflects analysis based on historical data and current forecasts, encouraging a long-term investment strategy guided by fundamental data.