10 Days and a $10 Trillion Market Swing: The Economic Ripple of Trump’s Tariffs and What Lies Ahead

The global economy is a dynamically shifting landscape, and few events illustrate its volatility quite like the tariff policies under President Trump’s administration. Just ten days after their announcement, these tariffs unleashed a staggering $10 trillion swing in the stock and bond markets, reshaping investment strategies and altering financial forecasts worldwide. But how exactly do tariffs influence these critical economic avenues? Let’s dive into this complex issue to uncover the tangible impacts and future implications.

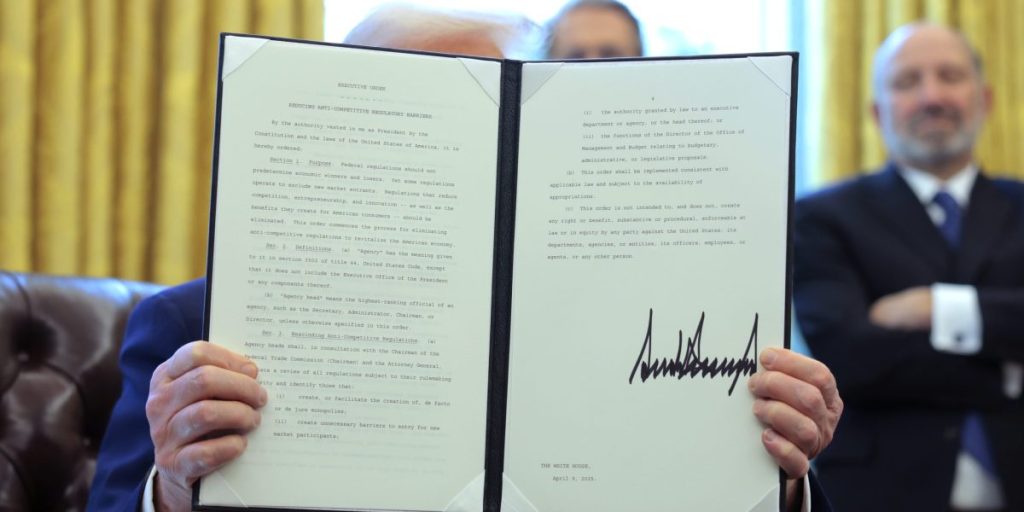

Understanding Trump’s Tariffs: A Background

A Shift in Trade Policy

In 2018, President Trump’s administration implemented a series of tariffs aimed at China and several other countries, sparking a global trade war. The primary goal was to protect American industries by making imported goods more expensive. However, the unintended consequences were felt across various sectors, stirring up uncertainty in global supply chains and financial markets.

Immediate Market Reactions

Upon the announcement of these tariffs, investors reacted swiftly. Concerns about escalating prices and the health of international trade led to significant volatility—particularly in technology and manufacturing sectors, which are heavily reliant on global supply chains.

The Stock Market’s Volatility

Tech Stocks Take a Hit

Tech giants like Apple and Microsoft, which manufacturing processes are tightly interwoven with Chinese suppliers, found themselves in a precarious position. As the market adjusted to the new tariffs, stock prices for these companies experienced significant fluctuations. Investors grew wary of reduced profit margins, which translated to declining share prices.

Financial Sectors Respond

The financial sector also experienced a seismic shift. Equity markets see-sawed as tariffs introduced a new layer of risk, prompting investors to reconsider their portfolios. Investors flocked to safer investments, pushing bond yields lower as demand surged.

Impact on the Bond Market

Interest Rates and Investor Sentiment

In the wake of the tariffs, the bond market demonstrated an intricate dance of supply and demand. Investor sentiment shifted, causing a movement towards government bonds as markets grappled with the uncertainty surrounding future economic growth. Lower yields signaled a pivot towards caution, indicating that investors sought to protect capital amidst increasing volatility.

Inflation Fears and Long-term Effects

As tariffs contributed to rising costs for consumers, there was a legitimate fear of inflation. This prompted speculation about potential interest rate hikes, further complicating the bond market’s landscape. Market analysts began parsing through the implications of these tariffs on long-term fiscal policy and interest rate decisions, leading to varied predictions about future economic conditions.

What Lies Ahead?

Navigating Tariff Waters

As the dust settles from the initial tariff shock, questions loom large about the long-term ramifications for investors and companies alike. How will businesses adjust their strategies? Will tariffs become a permanent feature of American trade policy? The answers will be critical for understanding future market behavior.

A Global Perspective

Looking forward, the ramifications of Trump’s tariffs extend beyond America’s borders. Countries affected by these tariffs are recalibrating their trade strategies and forging new alliances. As markets adapt, the global economy stands to be reshaped, offering opportunities for savvy investors who can navigate these changes effectively.

Conclusion: The Tariff Legacy

The imposition of tariffs changed the face of the global economy, unleashing a whirlwind of uncertainty and realignment across stock and bond markets. The staggering $10 trillion market swing over a mere ten-day span underscores the power tariffs hold in influencing economic conditions.

As we chart a course into the future, the effects of these policies will likely resonate for years to come, making it imperative for investors to remain vigilant and adaptable. By staying informed and strategically engaged, one can harness the unpredictable currents of the market—turning challenges into opportunities in these tumultuous economic times.

For more in-depth insights and analyses, you can check resources like Fortune and Bloomberg to stay updated on ongoing economic developments.