### Where is All the Money Coming From?

Curiosity about the ongoing trends in the stock market is at an all-time high. As investors rush to capitalize on dips, the question looms: **Where is all the money coming from?** In a landscape where **record inflows** are becoming the norm, the factors driving this momentum reveal much about today’s financial climate.

#### The Dip Buying Phenomenon

Recent reports indicate that investors are **unwavering in their commitment**, buying into the market even after substantial drops. According to [Bloomberg](https://www.bloomberg.com/news/articles/2025-05-19/yolo-crowd-s-record-dip-buying-binge-calms-a-jumpy-stock-market?srnd=homepage-americas):

> *”Retail traders went on a record dip buying spree Monday, reversing a 1% decline in the S&P 500 Index…”*

In just a single day, **individual investors poured a staggering $4.1 billion into U.S. stocks**, marking one of the largest influxes ever recorded for that time of day. This begs the question: What’s fueling this relentless investment?

#### The Key Players in the Money Game

Let’s break down the most significant **money sources** driving this surge.

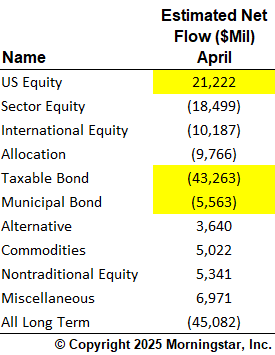

##### Bonds: The Unsung Heroes

Bonds may seem like a dull topic in the investment world, but they hold significant sway in today’s market. They serve **four essential purposes** for investors:

1. **Volatility reduction**

2. **Regular income**

3. **Spending power during stock downturns**

4. **Dry powder for strategic investments**

In April, many investors opted for that last option, funneling cash from bonds into **stocks during market dips**.

Data suggests investors sold off bonds to **buy into stocks**, providing much-needed liquidity during challenging times.

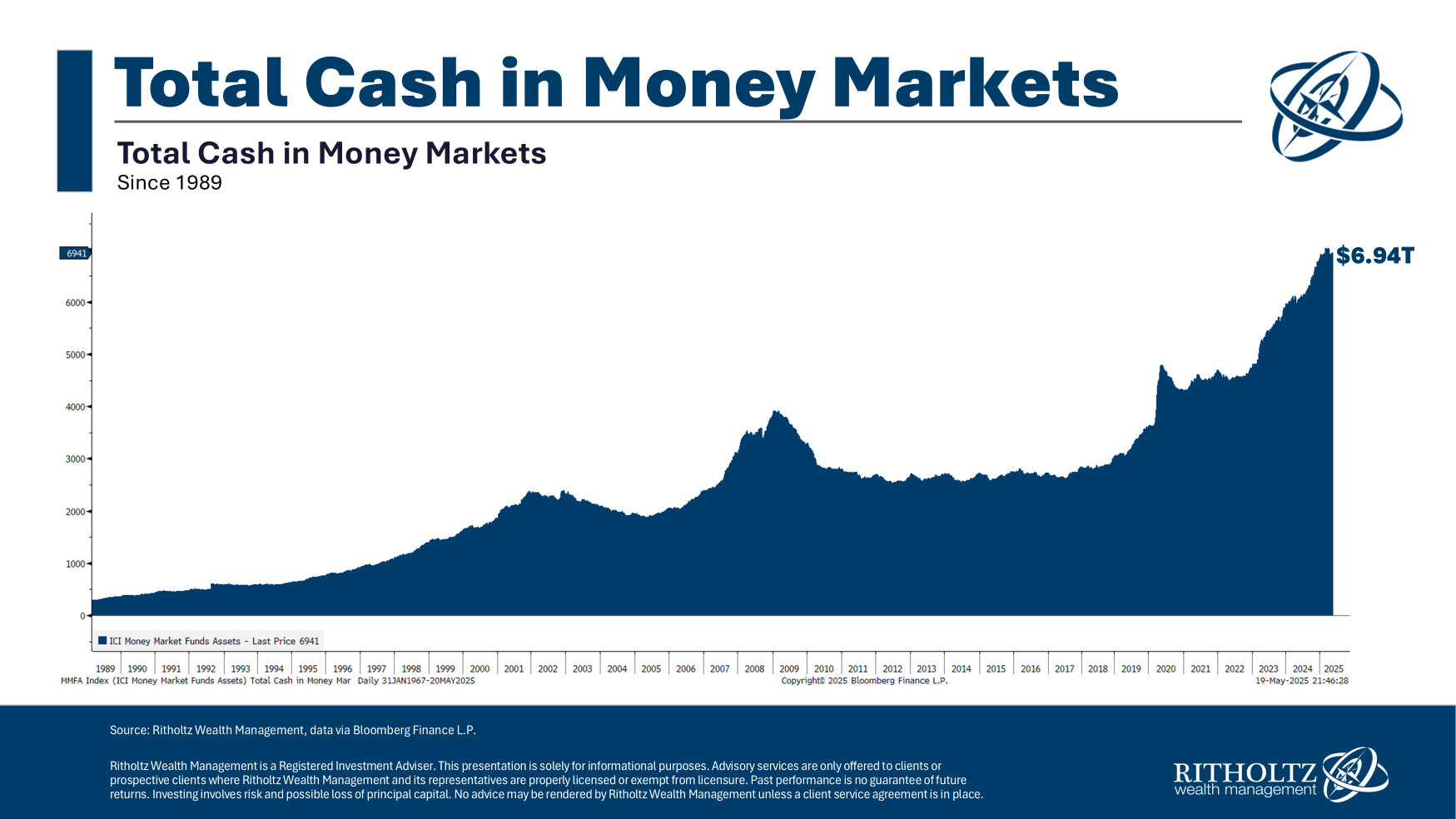

##### Money Market Funds: A Reservoir of Cash

There’s still a **huge amount** of capital sitting in money market funds—an astonishing **$7 trillion**, despite a rate cut by the Federal Reserve. As downturns pull investors back, many transfer funds to the stock market when opportunities arise.

Emerging statistics reveal that some of this cash made its way into stock purchases, igniting further interest in equity investment.

##### Cash on the Sidelines: Ready for Action

Checking and savings accounts still hold **considerable wealth**. Though data is only reported quarterly, many investors might be gearing up to inject cash into the equities market after the recent bear phase.

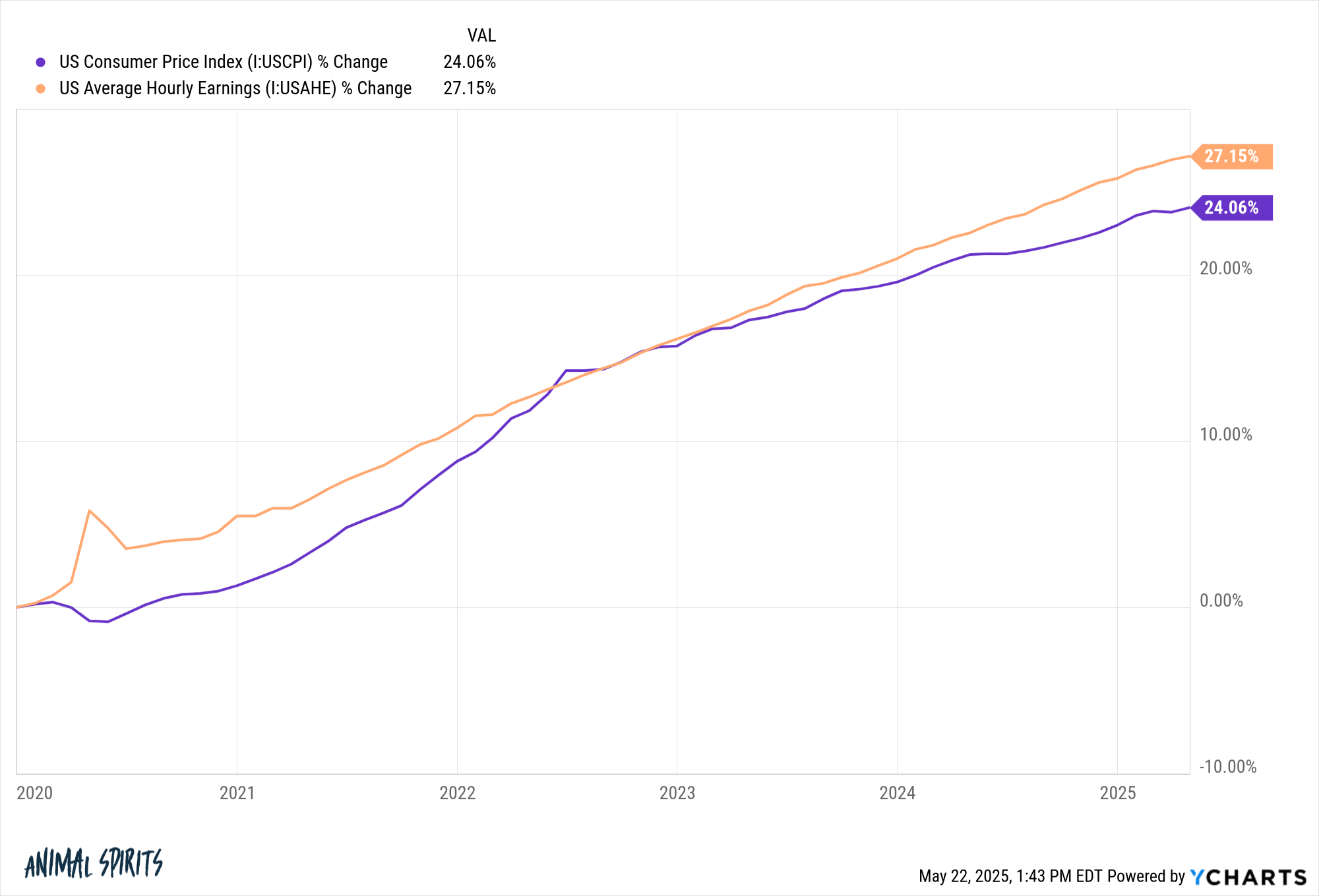

##### Wages: A Silver Lining

Despite a **24% cumulative rise** in prices during the 2020s, wages have surged over **27%** in total. This increase translates directly to more disposable income for savings and investments.

Now, as wages grow, **investment flows** are likely to follow suit, fuelling the cycle of buying on dips.

#### The Bottom Line: What Lies Ahead?

While the current landscape showcases robust investor sentiment, the question remains—**will this trend continue?** For now, the appetite for risk appears strong, but unpredictable market conditions could alter this trajectory.

In our recent discussion on [Animal Spirits](https://www.youtube.com/watch?v=h_mymc9hKkc), Michael and I delved into the ins and outs of retail investor behavior and much more. Make sure to subscribe to [The Compound](https://www.youtube.com/channel/UCBRpqrzuuqE8TZcWw75JSdw) to catch every insightful episode!

#### Further Reading

If you’re intrigued by the dynamics of the market, explore more on this topic with these resources:

– [The Dumb Money Isn’t So Dumb Anymore](https://awealthofcommonsense.com/2025/05/the-dumb-money-isnt-so-dumb-anymore/).

In conclusion, understanding where all this money is coming from offers a critical lens into the broader financial landscape. It’s an exciting time for investors—let’s see how the story unfolds.