Equity LifeStyle Properties, a leading owner and operator of manufactured home communities, RV resorts, and campgrounds across North America, has unveiled its financial performance for the quarter ending March 31. All financial insights are reported on a fully diluted share basis unless specified otherwise, providing a transparent look at the company’s latest achievements.

Operations Update: A Positive Momentum

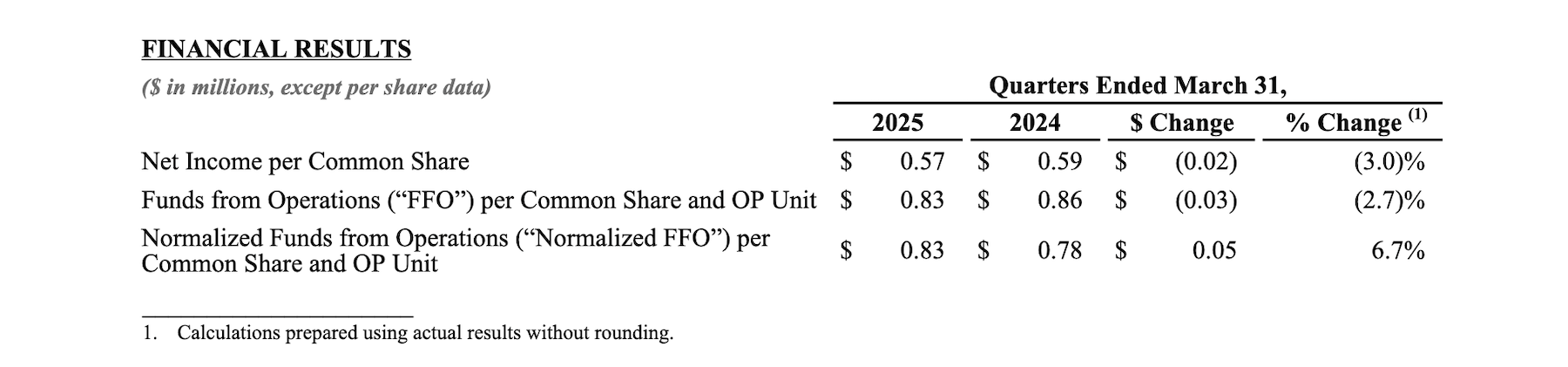

Equity LifeStyle Properties reported a **normalized FFO per common share and OP unit of $0.83**, marking an impressive **6.7% increase** compared to the same period last year. This result aligns perfectly with the company’s previous guidance range of **$0.80 to $0.86**. Gains were noted in core property operating revenues, which rose by **2.9%**, while core property operating expenses saw a modest **1.5% increase**. Significantly, core income from property operations (excluding property management) surged by **3.8%** for the quarter, showcasing the company’s robust operational health.

Manufactured Home (MH) Segment Shows Resilience

Within the manufactured housing sector, core MH base rental income witnessed a **5.5% increase** from the previous year. This growth stemmed from a **5.7% rise in rates**, despite a slight **0.2% decline in occupancy**—a consequence of storm damage affecting homes in six Florida communities late last year. Notably, the company successfully sold **117 new homes** during this quarter, with an average sales price hovering around **$81,000**. This combination of consistent demand and strategic pricing indicates a positive trajectory for the manufactured home market.

RV and Marina Operations: Steady Growth

The RV and marina sector showed promising results as well, with **core annual base rental income increasing by 4.1%** compared to the same quarter in 2024. This stability reflects the enduring popularity of outdoor recreational activities and the resilience of the RV market, which remains a viable lifestyle choice for many North Americans.

Controlling Property Operating Expenses

In a noteworthy achievement, the company completed its property and casualty insurance renewal as of April 1, realizing a **premium decrease of approximately 6.1%** compared to the previous year. This strategic move not only helps in cost management but also strengthens the bottom line, highlighting the company’s commitment to operational efficiency.

For those interested in diving deeper into the financial details, click here to access the full financial report. Equity LifeStyle Properties continues to pave the way in the manufactured housing and RV industry, illustrating a strong performance amidst evolving market conditions.

**Conclusion:** Equity LifeStyle Properties demonstrates a resilient operational model, fostering growth in both the manufactured home and RV sectors while effectively managing costs. The company’s strategic initiatives pave a pathway for sustainable success as it continues to adapt to market dynamics. Stay tuned for further updates as they navigate through the upcoming quarters!