In the dynamic landscape of real estate investment, insights from analysts can provide invaluable guidance for investors. **Over the past three months, six industry experts have offered their perspectives on Equity Lifestyle Properties (NYSE:ELS), showcasing a spectrum of opinions—from optimistic forecasts to cautious assessments.** Below, we delve into their evaluations and summarize the shifting sentiments surrounding this REIT (Real Estate Investment Trust).

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 2 | 0 | 0 |

| Last 30 Days | 0 | 1 | 0 | 0 | 0 |

| 1 Month Ago | 1 | 1 | 0 | 0 | 0 |

| 2 Months Ago | 0 | 0 | 0 | 0 | 0 |

| 3 Months Ago | 0 | 1 | 2 | 0 | 0 |

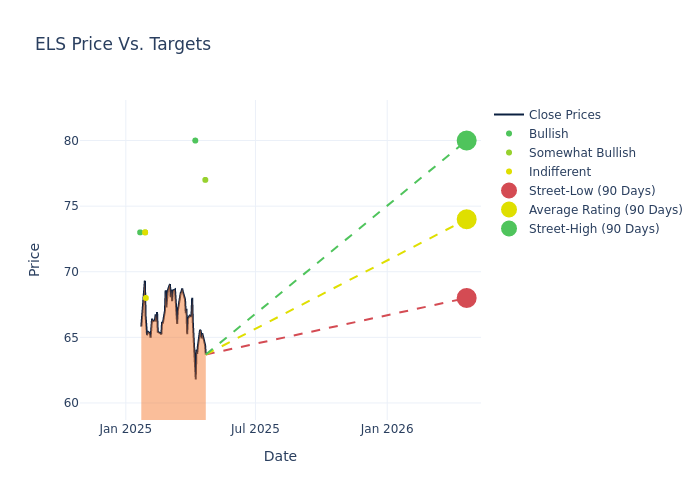

In terms of **12-month price targets**, analysts predict an average of **$74.83** for Equity Lifestyle Properties, with estimates ranging from a low of **$68.00** to a high of **$80.00**. This reflects a modest **2.16% increase** from the previous target of **$73.25**.

Deciphering Analyst Ratings: A Detailed Look

The landscape of Equity Lifestyle Properties becomes clearer as we analyze the latest actions of financial analysts. The summary below captures the sentiments of key analysts, their ratings modifications, and corresponding price targets.

| Analyst | Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Juan Sanabria | BMO Capital | Lowers | Outperform | $77.00 | $78.00 |

| Peter Abramowitz | Jefferies | Announces | Buy | $80.00 | – |

| Juan Sanabria | BMO Capital | Announces | Outperform | $78.00 | – |

| Brad Heffern | RBC Capital | Lowers | Sector Perform | $68.00 | $69.00 |

| Wesley Golladay | Baird | Raises | Outperform | $73.00 | $72.00 |

| Steve Sakwa | Evercore ISI Group | Lowers | In-Line | $73.00 | $74.00 |

Key Insights to Consider:

- Adaptive Actions: Analysts continuously adjust their recommendations based on fluctuating market conditions and company performance. Their responses reflect the ever-evolving landscape surrounding Equity Lifestyle Properties, offering valuable insight for potential investors.

- Ratings Spectrum: The qualitative assessments from ‘Outperform’ to ‘Underperform’ provide a window into how analysts foresee the company’s performance relative to the broader market, exposing opportunities and risks.

- Price Target Predictions: These projections help investors gauge Equity Lifestyle Property’s potential future value. Observing both current and prior targets can elucidate analysts’ shifting expectations.

**Staying abreast of these evaluations, in tandem with other financial indicators, can pave the way for a well-rounded understanding of Equity Lifestyle Properties’s market stance.** For more up-to-date insights, check out our Ratings Table.

Understanding Equity Lifestyle Properties

Equity Lifestyle Properties stands as a leader in the residential REIT sector, specializing in manufactured housing, residential vehicle communities, and marinas. With a portfolio of **452 properties** across the U.S., **38%** are strategically located in Florida, **12%** in Arizona, and **8%** in California. The focus remains on **attractive retirement destinations**, with a significant portion of the properties being age-restricted or populated by residents over **55 years of age**.

The Economic Footprint of Equity Lifestyle Props

Market Capitalization: **Equity Lifestyle Properties boasts a market capitalization that exceeds industry averages**, emphasizing its formidable presence compared to peers.

Revenue Trajectory: The company’s financial performance reveals a **0.36% revenue growth rate** as of **December 31, 2024**, showcasing notable progress, though it remains below the average of industry peers.

Net Margin Strength: With a robust net margin of **28.1%**, Equity Lifestyle Properties demonstrates superior profitability, effectively managing costs in a competitive environment.

Return on Equity (ROE): Their ROE stands out at **6.06%**, indicating efficient management and optimal utilization of shareholder equity capital, surpassing industry benchmarks.

Return on Assets (ROA): With an impressive **1.7% ROA**, the company excels in maximizing its asset use for superior returns.

Debt Management Insight: A **debt-to-equity ratio of 1.84** signals a heavier reliance on borrowed funds, highlighting potential financial risks for stakeholders.

Simplifying Analyst Ratings

Understanding analyst ratings is crucial for both seasoned investors and novices. These evaluations serve as critical indicators of stock performance, encompassing detailed analyses of financial health and market dynamics conducted by financial experts who monitor company performance closely.

Analysts not only generate ratings but also provide forecasts on growth, earnings, and revenue, delivering essential insights to investors—though it’s vital to remember that human perspectives can introduce variability to these assessments.

Breaking News: Wall Street’s Next Big Mover!

According to Benzinga’s top analysts, a certain stock is on the brink of explosive growth, potentially soaring over **200%** as market conditions shift dramatically. Don’t miss out on this opportunity! Click here for urgent details!.

This content was generated by Benzinga’s automated content engine and subsequently reviewed by an editor.

Latest Ratings for ELS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| April 2025 | BMO Capital | Maintains | Outperform | Outperform |

| April 2025 | Jefferies | Initiates Coverage On | – | Buy |

| April 2025 | BMO Capital | Upgrades | Market Perform | Outperform |

View More Analyst Ratings for ELS

View the Latest Analyst Ratings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.