Navigating the Wild Ride of Today’s Stock and Bond Markets

Every day in the financial markets feels like you’re navigating a classic car through an extreme roller coaster—unexpected twists and turns are the name of the game. Given the rapid pace at which information flows today, one could easily feel that time is racing ahead, leaving investors scrambling to keep up.

Understanding Recent Market Movements

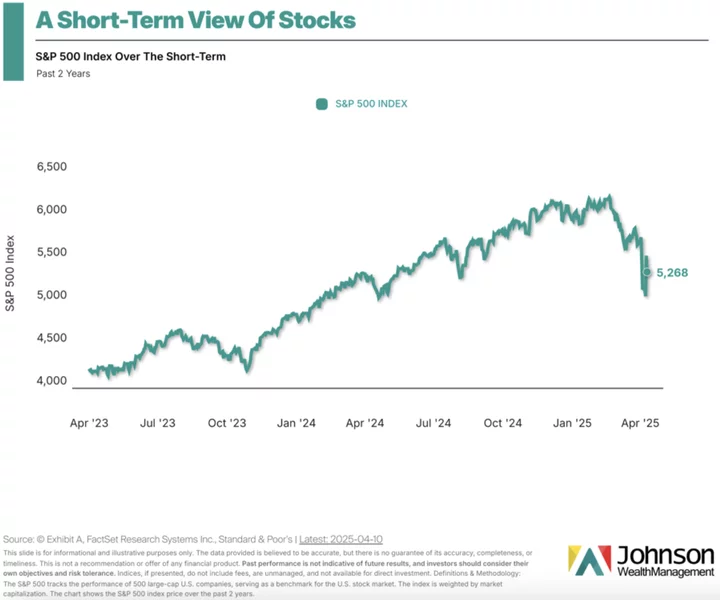

Recent events have demonstrated just how volatile the markets can be. This past Wednesday, a surprise announcement from the President regarding tariff adjustments sparked a fierce rally in stock prices. Following his remark that the public was "getting a little bit yippy, a little bit afraid," stocks surged by nearly 10% in a single day, showcasing how quickly market sentiment can shift. Yet, just as quickly, the tide turned once again on Thursday, illustrating the unpredictable nature of investing.

Bond Market Turmoil and Its Implications

Not only has the stock market experienced fluctuations, but the bond market has also seen dramatic changes, particularly with interest rates spiking. This volatility may have significantly influenced the administration’s decision to pause tariffs, acknowledging the interconnectedness between government policies and market reactions.

As Democratic strategist James Carville aptly put it back in the 1990s, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

The Challenge of Information Overload

In today’s information-saturated world, it can be particularly challenging for investors to decipher what truly matters. Philosopher Byung-Chul Han highlights a critical issue: our obsession with information and data can lead to heightened anxiety and cognitive overload. The nuances of experience, memory, and perception may fade amidst the barrage of fleeting updates.

To make sound investment decisions, it’s essential to step back and reassess the foundational aspects of your investing philosophy. Ask yourself the following questions:

- What are your financial goals?

- What is your risk tolerance?

- What kind of diversification do you need?

- How will you address the impact of inflation?

- Should you consult with a financial professional?

- What is your investment time horizon?

Back to Basics: The Foundation of Your Investment Strategy

Amid the chaos, it’s crucial not to get swept up in the whirlwind of market news. Even seasoned investors, like Howard Marks, acknowledge the uncertainty in the markets, as reflected in his recent memo titled “Nobody Knows (Yet Again).” It serves as a reminder that watching the news—whether on FOX, MSNBC, or from your favorite financial influencer—is not an investment strategy.

The Importance of Historical Perspective

Investing is not just about reacting to today’s news; it’s about understanding historical patterns. Stocks often start recovering long before the broader economic environment reflects any signs of improvement, a phenomenon that highlights the importance of patience and foresight in investing.

Feeling anxious during your investment journey is natural, as financial markets can be unpredictable just like life itself. With challenges arising from both market behavior and personal circumstances, it’s essential to stay focused on your long-term goals.

A Note of Positivity

The road ahead may seem daunting, yet it is crucial to maintain a positive mindset. Recently, a simple note from a barista brought a spark of hope: “What if it all turns out all right?” In times of uncertainty, keeping this perspective can be invaluable.

In Conclusion

Navigating today’s stock and bond markets requires a blend of strategic thinking, emotional resilience, and a commitment to your financial plan. Remember—stay grounded in your goals and the fundamentals of investing, as these principles will guide you through the ups and downs of the market landscape.

Sources:

- “Trump Pauses Reciprocal’ Tariffs, but Hits China Harder” (Wall Street Journal, April 9, 2025).

- Quoted in “The Daily Prophet: Carville Was Right About the Bond Market” (Bloomberg, January 29, 2018).

- Byung-Chul Han, “I Practice Philosophy As Art” (December 2, 2023).

Brandon Stockman has been a Wealth Advisor since the Great Financial Crisis and provides insights on investment management through Johnson Wealth Management. For more financial education, subscribe to his weekly newsletter or check out his YouTube channel.